52-53 Week Tax Year 2024 – This past year may have possibly knocked your financial goals off track, but that’s no reason to not jump back on the horse and take the 2024 money challenge. For this money challenge, we’ve broken . The Internal Revenue Service (IRS) defines a fiscal year as “12 consecutive months ending on the last day of any month except December. A 52-53-week tax year is a fiscal tax year that varies from .

52-53 Week Tax Year 2024

Source : www.cpajournal.com52 53 Week Fiscal Year: Consistent Time Period Comparisons CFO Edge

Source : www.cfoedge.comHow Long is a Year? The CPA Journal

Source : www.cpajournal.com2017 2024 Form IRS 2553 Fill Online, Printable, Fillable, Blank

Source : irs-form-2553.pdffiller.comHow Long is a Year? The CPA Journal

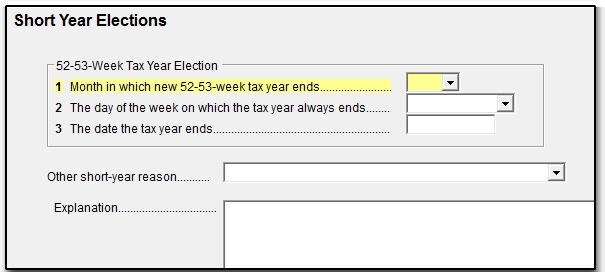

Source : www.cpajournal.comShort Year Return

Source : drakesoftware.comFiscal Year: What It Is and Advantages Over Calendar Year

Source : www.investopedia.comTranscat Reports double digit Organic Service Revenue Growth and

Source : aijourn.comDifferent Fiscal and Tax Years to Maintain Employees Florida

Source : www.floridaconstructionconnection.com4 5 4 Retail Calendar: How to Use + Free 2024 Download

Source : fitsmallbusiness.com52-53 Week Tax Year 2024 How Long is a Year? The CPA Journal: Part II is where you select your fiscal tax year. If you choose a calendar year, or a 52-53 week year ending in December for your fiscal year, you don’t have to fill out Part II. However . Section F of Form 2553 allows you to select the type of tax year your S-corp will use. You can select to use the calendar year or a 52- to 53-week year ending in December. But you can also select .

]]>

:max_bytes(150000):strip_icc()/FY-887c7c1cad1c47f38bd91db6e080b68e.jpg)